Tracing USDT, Bitcoin, and Ethereum: How Investigators Follow Digital Money

One of the most persistent myths in cryptocurrency fraud is that once funds are moved, they vanish into the blockchain forever. In reality, Bitcoin, Ethereum, and USDT are among the most traceable financial instruments ever created. Every transaction leaves a permanent, auditable trail—one that professional investigators can follow across wallets, platforms, and borders.

This article explains how digital asset investigators trace stolen cryptocurrency, the differences between tracing BTC, ETH, and USDT, and why professional blockchain analysis plays a decisive role in modern crypto recovery.

Why Cryptocurrency Is Traceable by Design

Blockchains were built to solve a trust problem—by making transactions public, immutable, and verifiable.

What this means for investigations:

Every transfer is timestamped

Wallet addresses are permanently recorded

Transaction paths cannot be erased

Fund movements remain visible years later

Unlike cash, cryptocurrency remembers where it has been.

Understanding the Three Most Commonly Traced Assets

Bitcoin (BTC): The Original Transparent Ledger

Bitcoin operates on a fully public blockchain, making it highly traceable when analyzed correctly.

Investigators can:

Follow BTC across unlimited wallet hops

Identify consolidation patterns

Detect peeling chains used in laundering

Track deposits into centralized exchanges

Although Bitcoin wallets are pseudonymous, patterns reveal ownership over time.

Ethereum (ETH): Smart Contracts Leave Extra Evidence

Ethereum adds another layer of traceability through smart contracts and token interactions.

ETH tracing includes:

Wallet-to-wallet transfers

Smart contract execution logs

Interaction with DeFi protocols

Token swaps and approvals

Each interaction creates additional forensic signals investigators can analyze.

USDT (Tether): Compliance Meets Traceability

USDT is one of the most frequently used assets in crypto scams—and one of the most recoverable.

Why USDT is different:

Issued by a centralized entity

Subject to compliance controls

Can be frozen at the token level

Frequently routed through exchanges

USDT tracing often provides strong leverage in recovery cases.

How Investigators Follow Digital Money Step by Step

Step 1: Transaction Mapping

Investigators begin by mapping:

Originating wallet (victim)

Initial scam wallet

Intermediate hops

Final known destination

This creates a transaction graph that visually represents fund movement.

Step 2: Wallet Clustering

Criminals use multiple wallets—but behavior links them together.

Clustering techniques identify:

Wallets controlled by the same entity

Reused spending patterns

Shared gas fees or timing

Common exchange deposit behavior

Clusters transform scattered addresses into organized networks.

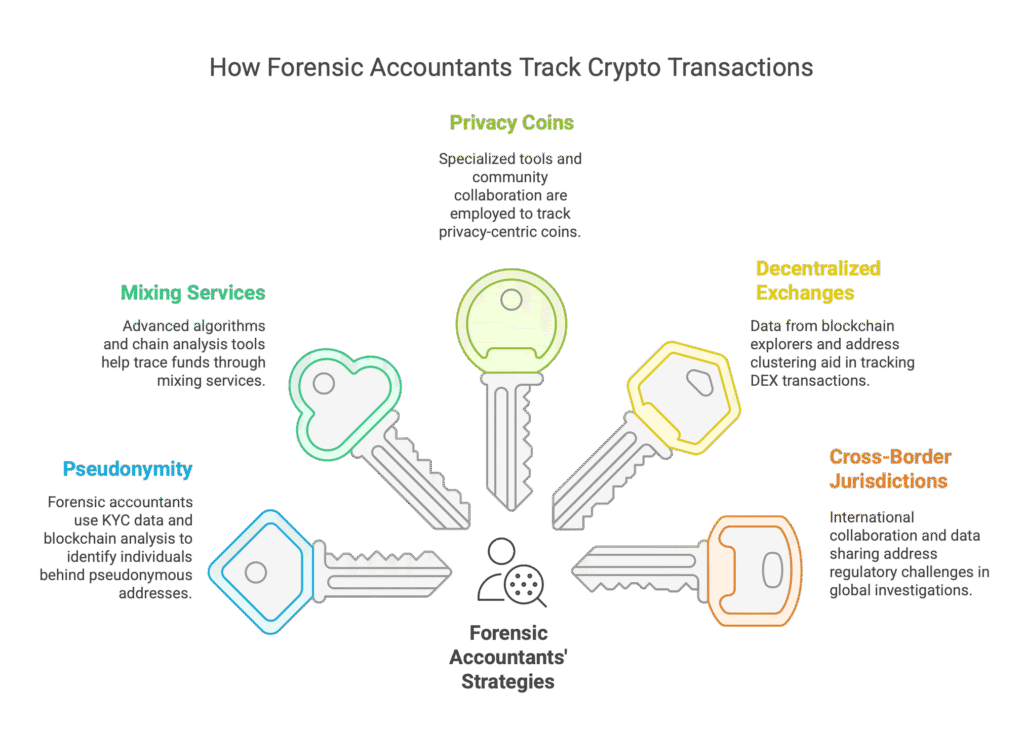

Step 3: Laundering Pattern Identification

Professional analysts recognize common laundering tactics:

Rapid hopping

Time-delay transfers

Cross-chain bridges

Token conversions

Use of privacy tools

Recognizing these patterns helps predict next moves.

Where Tracing Turns Into Recovery

Tracing alone is not recovery. Recovery begins when funds intersect with controlled environments.

Key intervention points include:

Centralized exchanges

Custodial wallets

Stablecoin issuers

Payment processors

At these points, blockchain evidence becomes actionable.

Why Professional Tools Matter

Public block explorers show transactions—but they don’t explain them.

Professional investigations use:

Advanced graphing software

Risk scoring systems

Cross-chain analytics

Historical wallet databases

Behavioral heuristics

These tools convert raw data into legal-grade intelligence.

Common Misconceptions About Crypto Tracing

“If funds pass through a mixer, they’re gone”

False. Mixers complicate tracing but do not eliminate patterns—especially when funds later exit to exchanges.

“Bridges make funds untraceable”

Incorrect. Cross-chain movements are traceable when mapped correctly.

“Only law enforcement can trace crypto”

Not true. Professional forensic teams regularly trace assets and support legal recovery efforts.

Why Victims Cannot Do This Alone

DIY tracing fails because:

Data becomes overwhelming

Patterns are misinterpreted

Legal framing is missing

Exchanges require formal escalation

Errors weaken credibility

Effective tracing requires experience, tools, and authority.

How the Fraud Counsel Department Conducts Asset Tracing

The Fraud Counsel Department uses a structured investigative methodology:

Full transaction reconstruction

Asset-specific tracing strategies (BTC, ETH, USDT)

Cross-chain movement analysis

Exchange touchpoint identification

Evidence preparation for legal escalation

Tracing is not about curiosity—it’s about recoverability.

Why Tracing Speed Matters

The earlier tracing begins:

The fewer laundering layers exist

The more exchange leverage is available

The stronger the legal position

The higher the recovery probability

Delay benefits criminals—not victims.

What Victims Should Preserve Immediately

If your crypto has been stolen:

Wallet addresses involved

Transaction hashes (TXIDs)

Exchange deposit confirmations

Dates, times, and asset types

Scam communications

Evidence quality directly impacts tracing success.

Digital Money Leaves Digital Footprints

Bitcoin, Ethereum, and USDT do not disappear. They move—and movement creates evidence.

With the right expertise, those footprints lead to accountability.

Begin Tracing Before the Trail Goes Cold

If you’ve experienced cryptocurrency theft, professional tracing can determine whether recovery is still possible.

📞 Confidential Consultation: +1 (332) 203-6168

📧 Support Team: Admin@fraudcounsel.net

📍 U.S. Office: 1270 Avenue of the Americas, 7th Floor, 10020, NY